Assessor

I want to welcome you to the Sabine Parish Assessor's Website.

Sincerely,

Chris Tidwell

Sabine Parish Assessor

Assessor Responsibilities

The Sabine Parish Assessor is responsible for discovery, listing, and valuing all property in Sabine Parish for ad valorem tax purposes. This property includes all Real Estate, all Business Movable Property (Personal Property), and all Oil & Gas Property and Equipment. The Assessor is responsible to the citizens of Sabine Parish for ensuring all property is assessed in a fair and equitable manner. At the same time, the Assessor is responsible for ensuring that assessments are calculated according to the Constitution of the State of Louisiana and the Revised Statutes that are passed by the Legislature. In Louisiana, “Ad Valorem”, by value, is the method to calculate taxes. The Assessor does not establish the “taxes”. Taxes are approved by the voters in the form of millage propositions on the ballot.

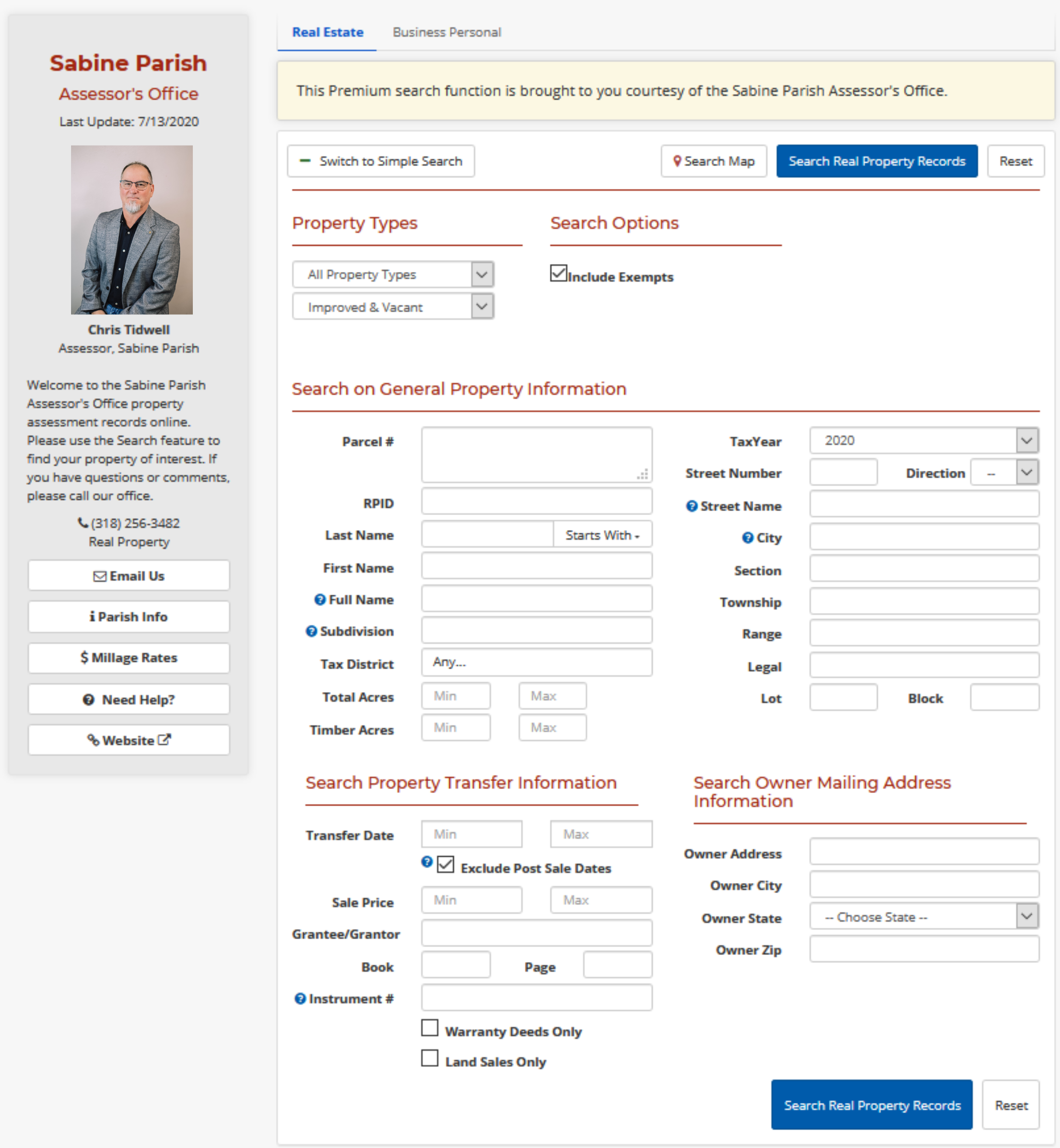

Real Property Search

Sabine Parish's real estate records are available online and free to the public. Search records using a variety of different search criteria such as name or address.

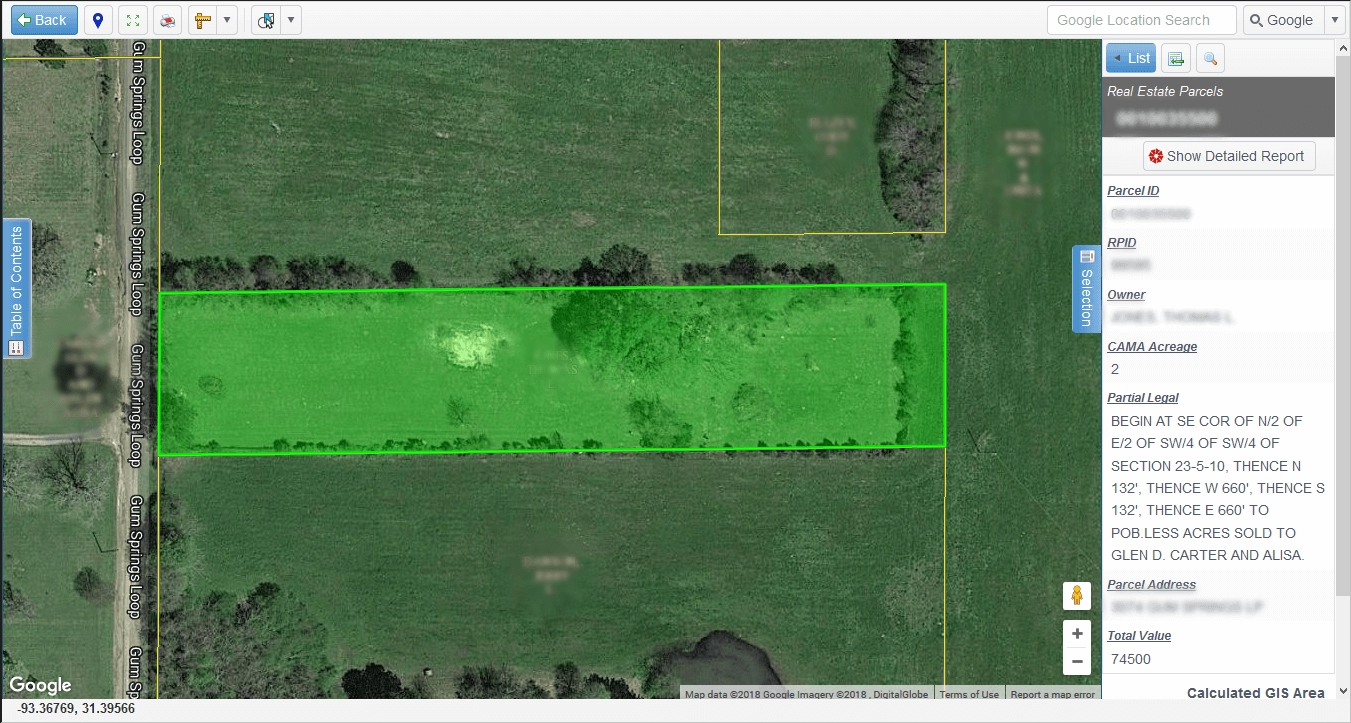

Interactive Mapping

Use the power of the interactive mapping functionality by searching, viewing, and selecting different properties of interest directly on the map.

Forms / Links

Find common forms for assessing and appeals.

View links to local and state agencies.

Upcoming Dates

April 1

Deadline for filing self-reporting forms for business personal property & oil/gas LATS.

Important Dates

- April 1 - Deadline to return self reporting forms (LATS) for business personal property and oil/gas LATS.

- July 15 - Value letters will be mailed. This is a required notice to inform you about changes to your assessment. If any questions, please come by or contact our office.

- July 31 - Notice to the Louisiana Tax Commission (LTC) of Public Exposure/Open Book dates.

- August 17 - Books are open for review of the 2026 tax roll.

- August 31 - Books close for the 2026 tax roll.

- September 9 - Last date to file appeal with the Board of Review.

- September 16 - Board of Review (BOR) meets.

- October 19 - Deadline to appeal BOR decision to LTC:

- No later than November 1 - Submit tax roll to the LTC.

- December 31 - Property taxes are due and payable to the Sabine Parish Sheriff's office/tax collector.

PLEASE NOTE: YOU MUST SUBMIT ALL INFORMATION CONCERNING THE VALUE OF YOUR PROPERTY TO THE ASSESSOR BEFORE THE DEADLINE FOR FILING AN APPEAL WITH THE BOARD OF REVIEW. THE FAILURE TO SUBMIT SUCH INFORMATION MAY PREVENT YOU FROM RELYING ON THAT INFORMATION SHOULD YOU PROTEST YOUR VALUE.

- Within 30 days or the earlier:

- 1. Actual delivery of the BOR decision

- 2. Written notice of the BOR determination